Strategic Financial Solutions

Across Key Industries

Specialized asset solutions tailored to your sector's unique requirements and challenges.

Industry-Specific Expertise for Complex Financial Needs

At Waterford Capital Partners, we understand that every industry has unique financial requirements. Our sector-specialized approach combines deep industry knowledge with flexible financial solutions to help businesses optimize assets, fund growth, and navigate market transitions.

Sector Overviews

01.

Steel & Metals

Key Challenges:

- Cyclical commodity pricing

- Energy-intensive operations

- Global competition

02.

Metalworking & Fabrication

Key Challenges:

- CNC equipment costs

- Skilled labor shortages

- Automotive sector volatility

Our Solutions:

- Machine tool financing

- Sale and leaseback on complete factory

- Asset purchase solutions

03.

Food Processing

Key Challenges:

- Timing on inventory

- USDA/FDA compliance

- Private label pressure

Our Solutions:

- Complete asset leases

- Packaging line modernization

- Private label expansion

04.

Pharmaceuticals

Key Challenges:

- GMP compliance costs

- Long R&D cycles

- Patent cliffs

Our Solutions:

- Clean room facility financing

- Equipment leases

- Bridge loans

05.

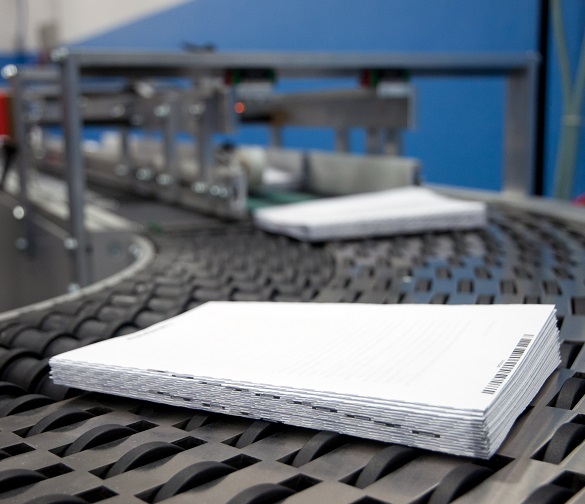

Paper & Print

Key Challenges:

- Digital disruption

- Fiber cost volatility

- Sustainability mandates

Our Solutions:

- Offset press modernization

- Recycled pulp system financing

- Digital transition packages

06.

Chemicals

Key Challenges:

- Energy prices

- Feedstock price swings

- Capacity utilization

Our Solutions:

- Complete take-over

- Distillation column leases

- Specialty chemical inventory lines

07.

Plastics

Key Challenges:

- Resin price volatility

- Single-use plastic bans

- Circular economy transition

Our Solutions:

- Equipment financing

- Recycling system funding

- Biopolymer R&D capital

08.

Electronics

Key Challenges:

- Obsolescence risk

- Chip shortages

- Swing in demands

Our Solutions:

- Complete factory or SMT line financing

- Clean room construction loans

- Semiconductor test equipment leases

Our Capabilities

While each sector has unique needs, we provide consistent excellence in

Regulatory Navigation

Compliance-aware structuring

Transition Support

Financing for digital and green initiatives

Working Capital

Custom solutions for inventory and receivables